The Vital Role of Ethics in Modern Accounting

Adopting ethical standards in accounting can significantly enhance your organization’s integrity. By fostering a culture of ethical behavior in financial management, you establish a foundation for trust, ensure transparency in financial reporting, boost employee morale, and promote sustainable financial development.

The past twenty years have seen a notable increase in financial scandals stemming from misstatements and fraudulent activities involving numerous accountants and prominent accounting firms. The shortcomings in management reporting and oversight processes are regarded as significant ethical concerns. In light of the failures experienced by many large firms and organizations globally, scholars have begun to question and express skepticism about the roles of auditors and accounting professionals. Additionally, there is an escalating concern regarding the ethical standards within the accounting profession, as ethical dilemmas frequently arise in this field, especially with the digital age implications.

International accounting standards are therefore being adopted on a very wide scale worldwide. A recent study conducted by the International Federation of Accountants (IFAC) reveals that approximately 80% of jurisdictions globally have implemented International Standards for Auditing for mandatory audits.

In our article, we’ll get to the ethical considerations in the accounting profession, the impact of the digital age on ethical considerations, and how to mitigate the challenges posed by digitalization.

Accounting and Ethical Standards:

The concept of ethics in accounting encompasses the essential principles and values that guide the conduct of professionals in the field. It focuses on making ethical decisions, ensuring transparency, and demonstrating a dedication to integrity. Ethical conduct is crucial in the accounting profession as it enhances credibility, promotes long-term sustainability, and establishes a basis of trust in financial practices and reporting.

Ethical standards are mainly targeted towards mitigating the challenges that the profession faces as a result of unlawful practices. Such dilemmas may arise in the preparation of fair financial statements due to the agency issues that can exist between management and stakeholders, as well as between accountants and stakeholders. The pressures, interests, and potential interests of management may lead to the creation of distorted financial statements. Nevertheless, auditors find themselves in a predicament as they must balance the need to maintain a long-term professional relationship with company management while fulfilling their responsibilities with due diligence. Financial fraud and inaccuracies in reporting represent significant issues, primarily stemming from accountants’ failure to adhere to established standards, rules, and regulations. Additionally, the ineffectiveness of organizational governance and internal control systems plays a crucial role in influencing the quality of accounting and auditing practices.

One of the global-setting standards agencies is the International Ethics Standards Board for Accountants (IESBA), which operates as an autonomous global standard-setting body. Its mission is to uphold the public interest by establishing ethical standards, including those related to independence, which serve as a foundation for ethical conduct in businesses and organizations. The IESBA has been publishing an annual code of ethics for accounting in order to encourage organizations worldwide to adopt and adhere to the same code of ethics worldwide. The code of ethics includes five fundamental principles: Integrity, Objectivity, Confidentiality, Professional Behavior, Professional competence, and due care. Most prominent companies strive to adopt those standards and get them embedded inside their processes and culture.

The Impact of the Digital Age on Accounting Ethics:

Digitalization has been a double-edged sword, providing opportunities to the accounting profession while posing huge and multiple risks as well.

Artificial Intelligence (AI), for example, facilitates the automation of monotonous and time-intensive tasks. Functions such as data entry, reconciliation, and transaction processing can now be executed rapidly and precisely by AI-driven systems, allowing accountants to dedicate their time to more strategic endeavors. This automation not only enhances operational efficiency but also mitigates the likelihood of human error, resulting in superior quality in financial reporting and analysis. Additionally, AI-powered forecasting models can generate real-time predictions, allowing accountants to anticipate future trends and make proactive decisions to optimize financial outcomes.

The implementation of AI in automating repetitive tasks and optimizing processes can result in considerable cost reductions for organizations. AI-driven systems minimize the necessity for manual input, thereby decreasing the reliance on human labor and lowering operational expenses. Furthermore, AI can improve client services and stakeholder interactions by delivering more tailored and prompt insights. Through AI-powered analytics, organizations can produce personalized reports and recommendations that cater to the specific needs of each client.

On the other hand, according to the latest update of the IESBA code of conduct, it has listed that the emerging technologies constitute major threats to compliance with the code of ethics principles, as follows:

Artificial Intelligence:

Performance reviews can be prone to unconscious bias, which can result in a self-interest or familiarity threat to objectivity. AI systems are themselves subject to bias, but when used appropriately, AI-enabled tools can also help identify and mitigate these threats.

Internet of Things:

IoT devices are prone to cybersecurity weaknesses. If the firm:

- does not recognize the inherent security risks of IoT devices or

- assumes that the client is adequately addressing the risks; this could lead to a familiarity threat to the confidentiality of client information.

Blockchain:

New blockchain systems are often tested by running parallel to the legacy system, with reconciliations. Pressure to save costs or even skip this step might give rise to a self-interest threat to objectivity (through over-reliance) and to professional competence and due care.

Cloud-Based Storage of Client Data:

Independence might be threatened if the cloud service provider maintains only a copy of the client’s IoT-generated data and acts under the direction of the firm.

Strategies for Upholding Ethical Standards in the Digital Age:

Addressing the ethical challenges posed by emerging technologies in accounting requires proactive measures to promote transparency, ensure data privacy and security, and address bias and fairness.

In a 2017 survey by the ACCA (The Association of Chartered Certified Accountants) about Ethics and Trust in the Digital Age, conducted among over 10,000 professional accountants (including trainees) and among over 500 senior managers, respondents shared their views about the most important strategies to uphold ethical standards in the digital age.

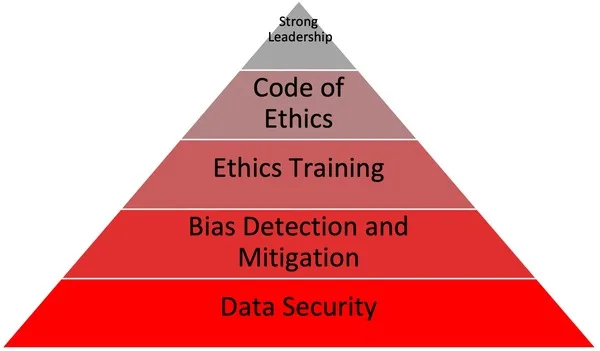

Strong leadership to set the tone at the top was cited as the top area (by about two-thirds of respondents) where support is needed for promoting ethical behavior in organizations. The second most commonly cited need, chosen by just over half the respondents, was for support in creating, implementing, and managing a code of ethics for the organization. The next couple of priorities for support relate to building up the understanding of ethical considerations in a digital context.

A few more than half of the respondents reported the need for support in ‘raising awareness’ about the repercussions of breaching the code of ethics, while a slightly smaller number preferred a training-based approach to teach best practices. Also, 43% of respondents said they would like support with establishing evaluation processes: mechanisms to assess whether the behavior is ethical or not. Fewer than half the respondents cited a well-publicized ‘speak-up’ policy with appropriate anonymity or protection features. The findings suggest the need to explore whether there is sufficient encouragement to ensure that professional accountants feel able to report inappropriate or unethical behavior. Reporting unethical behavior may be an area that needs further strengthening in order to help professional accountants act as the ‘ethical conscience’ of their organizations. Establishing an ethics committee to consider ethical dilemmas and embed ethical culture was cited by the fewest respondents as an area needing support.

Protecting sensitive financial data is fundamental in AI-driven accounting. To ensure data privacy and security, accountants can implement robust data protection measures, such as encryption, access controls, and data anonymization, to protect sensitive data from unauthorized access or breaches.

To address bias and ensure fairness, accountants can regularly monitor and evaluate AI systems for bias, using techniques such as bias detection algorithms and fairness metrics. It is also highly recommended that strategies for bias detection and mitigation be implemented, such as using diverse and representative datasets and regularly updating AI models to reduce bias over time.

Creating and implementing ethical guidelines and governance structures specific to AI-driven accounting can help mitigate ethical risks and ensure ethical decision-making.

Ahmed Mamdouh & Co. Kreston is one of the leading companies in leveraging the latest technologies and top-notch strategies to ensure ethical considerations are strictly met. The company heavily embeds the latest emerging technologies in its operation so that it can provide clients with a unique experience. It is therefore an integral part of our work to mitigate the accompanied challenges through a myriad of strategies. Clients’ data protection is highly safeguarded through all possible legal and technological solutions.

Our highly experienced team is ready to put your company on the right path to safely unleash the potential of emerging technologies through a secure and well-defined strategy.

References:

https://www.accaglobal.com/content/dam/ACCA_Global/Technical/Future/pi-ethics-trust-digital-age.pdf

https://www.ifac.org/news-events/2018-04/global-accounting-ethics-audit-standards-achieving-worldwide-adoption

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3553336

https://www.fepbl.com/index.php/ijae/article/view/1230

https://www.jaepp.org/index.php/jaepp/article/view/349/329

https://www.ifac.org/knowledge-gateway/discussion/exploring-iesba-code

https://www.highradius.com/resources/Blog/accounting-ethics-and-integrity/#:~:text=Accountants%20must%20be%20honest%2C%20truthful,%2C%20colleagues%2C%20and%20the%20public